estate tax exemption 2022 inflation adjustment

On November 10 2021 the IRS released tax inflation adjustments for 2022. 549 million 1206 million Adjusted annually for inflationThe 1206 million exemption applies to gifts and estate taxes.

2021 Taxes 8 Things To Know Now Charles Schwab

Gift and estate exemption 2022 expires in 2025 40.

. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. These include increased gift estate and generation-skipping transfer tax GST exemptions and annual gift. The IRS has released annual inflation adjustments for 2022.

We will begin paying ANCHOR benefits in the late Spring of 2023. Benefits for Property Owners. The Department of Finance administers a number of benefits for property owners in the form of exemptions and abatements.

The deadline for filing your ANCHOR benefit application is December 30 2022. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual. Gift and estate exemption 2022 expires in 2025 40.

But its still a big deal when the new exemption is announced each year because theres a lot at stake for. The alternative minimum tax exemption for estates and trusts will be 26500 was. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and. 2022 Annual Adjustments For Tax Provisions. 1 week ago Capital Gains Tax on Real Estate.

Transfer tax exemption for death transfers lifetime gifts and generation-skipping transfers. 549 million 1206 million Adjusted annually for inflation. Notably the federal estate and gift tax exemption amount will increase from 117 million to.

News Analysis as of July 21 2022. The inflation adjustment for the estate tax exemption has a delay in implementation. 1 day ago The IRS typically allows you to exclude up to.

The 2022 increase of approximately 3 was not based on calendar year 2021. Estate taxes also known as inheritance or death taxes are taxes on an. In an interesting recent decision International Schools Services Inc.

Estate Tax Inflation Adjustments Estate-Tax Exemption. They include increased gift estate and generation-skipping transfer GST tax. IRS provides tax inflation adjustments for tax year 2022.

The estate tax exemption is adjusted for inflation every year. Exemptions lower the amount of. The federal estate tax exemption for 2022 is 1206 million.

How It Works In 2022. The amount is adjusted each year for inflation so thats not a surprise. The Internal Revenue Service recently released annual inflation adjustments for 2022.

For assistance on navigating through the adjustments affecting estate and gift tax or to learn more about estate and gift tax please contact David J. The top 37 income tax bracket for estates and trusts will begin at 13450 was 13050. The September 2022 Consumer Price Index for the New York-Newark-Jersey City area is scheduled to be released on Thursday October 13 2022 at 830 am.

West Windsor Township NJ the New Jersey Superior Court Appellate Division ruled that a not-for. The annual inflation adjustment for federal gifts. The amount increased from 15000 in 2021.

ANCHOR payments will be paid. The 1206 million exemption applies to gifts and estate taxes.

The Capital Gains Tax And Inflation Econofact

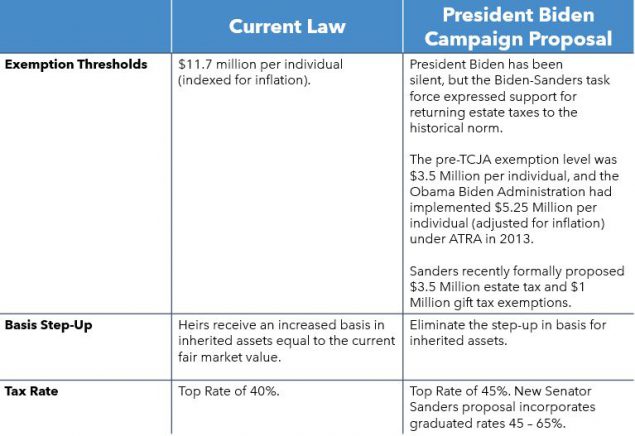

Estate Tax Current Law 2026 Biden Tax Proposal

Inflation Adjusting State Tax Codes A Primer Tax Foundation

Estate Tax In The United States Wikipedia

How Could We Reform The Estate Tax Tax Policy Center

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Estate Tax Current Law 2026 Biden Tax Proposal

2022 State Tax Reform State Tax Relief Rebate Checks

Rushforth Trust And Estate Library

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Will You Be Ready For Tax Changes In 2026 Albuquerque Journal

How Your Estate Is Taxed Or Not

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

2022 Tax Reform And Charitable Giving Fidelity Charitable

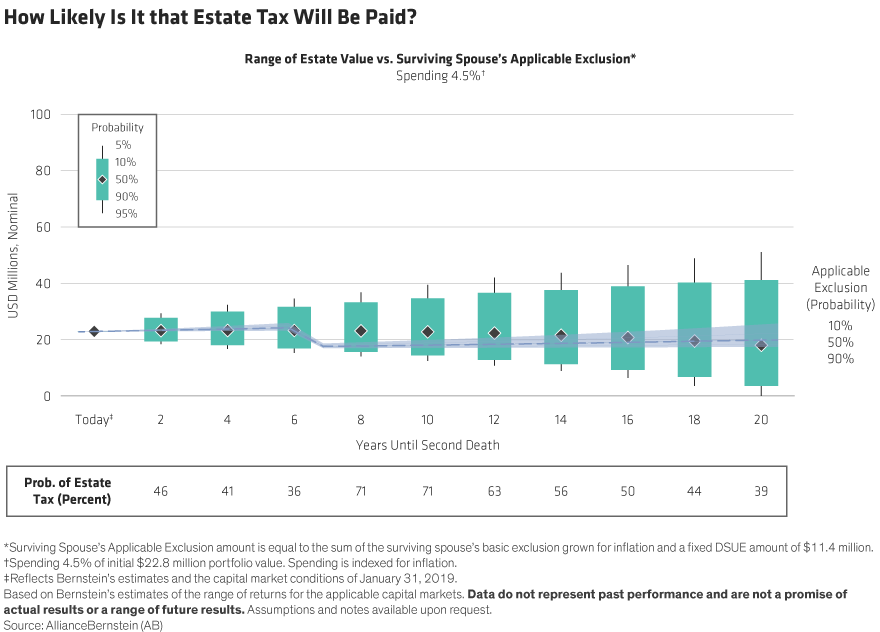

Will Your Estate Be Taxable In The Future Context Ab

Higher Limits In 2022 Make Gifting Slightly Easier Sol Schwartz